There is a huge paradox around lifetime value: it is undoubtedly the essential business indicator, especially in e-commerce…but only a minority of businesses use it.

According to an English study, only 34% of marketers say they know what lifetime value means. When you realize everything you can do with this indicator, it’s to die for. And it’s not just about measurement and reporting but, more importantly, about activation potential.

So, if you want to increase your income, you must calculate and use the lifetime value.

Let’s find out together what lifetime value is and, more importantly, how to use it intelligently to maximize your client assets.

📕 Summary

What is Lifetime Value or LTV?

Definition

Lifetime value is a business indicator that estimates the amount of revenue generated by a customer over its entire lifetime.

This indicator lets you know how much a customer earns you throughout their relationship with your company, from their first purchase until the moment they end the relationship.

If a client generates an average of 50 euros in revenue per month and remains a customer for 3 years, their lifetime value will be 50 x 12 x 3 = 1,800 euros. The lifetime value is a monetary value, so it will be expressed in euros, for example.

Lifetime value is also called “customer lifetime value,” but more rarely. The acronym LTV (or CLTV) is very common.

A few clarifications should be made:

- The lifetime value is the sum of the average revenue (i.e., the margin) generated by a client throughout their life. BUT, sometimes turnover is used instead of income.

- The lifetime value is an estimate. By definition, it is not possible to determine the lifetime value of Mr. Dupont before he has ended his relationship with your company. However, it is possible to estimate his lifetime value based on his profile, the data available to your IS, the lifetime value of the customer segment to which he belongs, etc.

- The lifetime value can be calculated at several levels: at the global level (all your customers), at the level of a customer segment, or even at the level of each customer.

Lifetime Value is a key indicator in business sectors where controlling acquisition costs is crucial. This concerns in particular:

- Subscription business models, SaaS businesses, for example.

- Retail and E-commerce.

Focus on 4 Lifetime Value use cases

Here are some typical LTV use cases. The list is far from being exhaustive.

Use case #1 – Determine the target customer acquisition cost (CAC)

Estimating how much a given customer will bring you in total allows you to assess the maximum marketing and sales investments to acquire that customer. The underlying idea is that it is absurd to spend more to acquire a customer than the revenue that customer will bring to the company.

If you know the client will earn you an average of $10,000; you can justify investing $3,000 to convert them. Marketing and sales efforts should always be commensurate with the revenue expected.

Along the same lines, you can use LTV to identify the break-even point, where the revenue generated exceeds the cost invested.

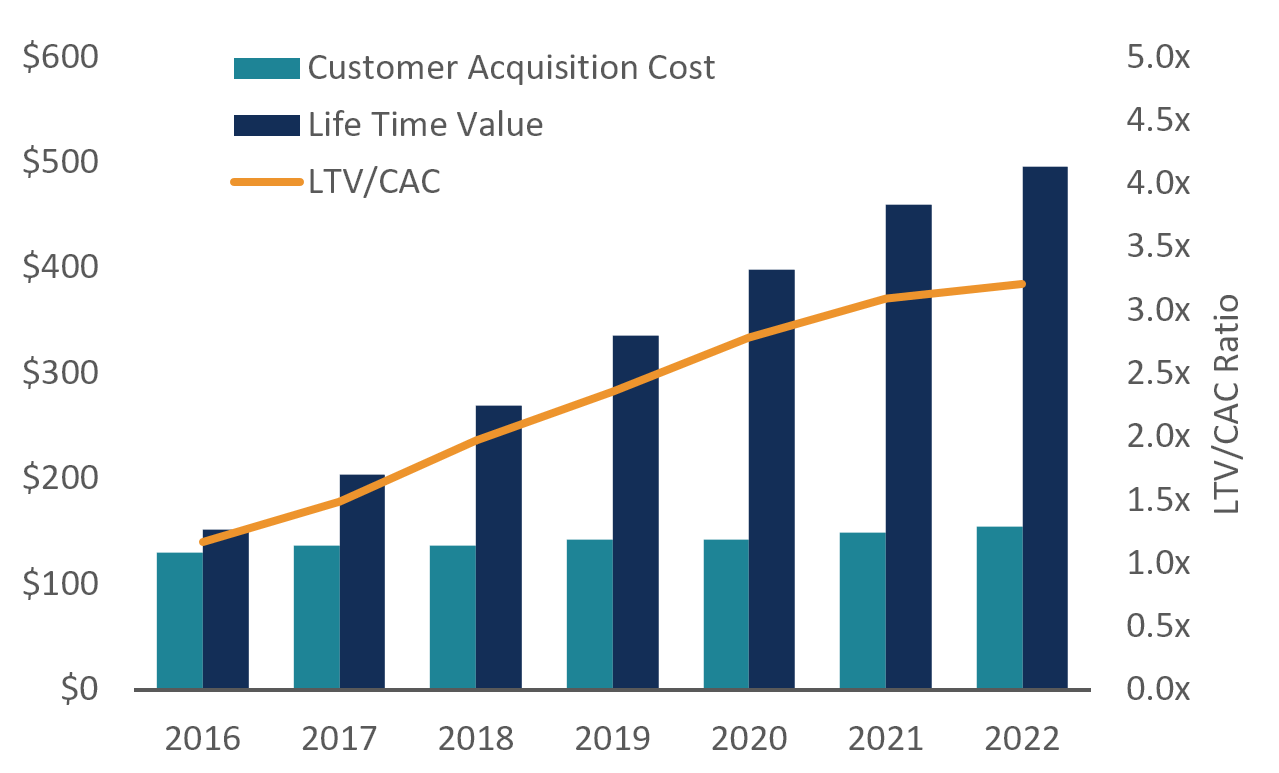

The LTV / CAC ratio is very important.

If the ratio is less than 1, the activity is not viable. When the ratio is greater than 3, it is an excellent sign, provided it is stable.

Source: Ecommerce Finance Model Valuation

Use case #2 Target the most profitable customers first

We assume that you have already built a customer segmentation. If so, then LTV is one of the most relevant metrics to gauge the value of each segment. We strongly encourage you to calculate the LTV of your different segments. This way, you will identify your best segments. You can then imagine specific actions for these VIP customers, remembering to pamper them!

In this case, just as before, the Lifetime Value indicator appears to be an excellent tool for optimizing marketing efforts and investments.

Use case #3 – Identify your weak points and areas for improvement

All the work required to calculate the Lifetime Value will help you identify weak points or at least areas for improvement in your business. The use of Lifetime Value induces a resolutely “customer-centric” way of thinking that can only enlighten you on many things! For this reason alone, and in the process of continuous improvement, calculating the Lifetime Value of your customers and your segments is worthwhile.

Use case #4 – Plan your annual advertising budget

This ties in with what we said above. If you know your LTV, you can more easily and more accurately determine the budget to invest in acquisition, advertising campaigns, etc.

How to calculate LTV?

Now that you know the definition of Lifetime Value and its possible uses, let’s see how you can calculate it.

Is there a single LTV calculation formula?

No, there are several formulas to calculate the Lifetime Value for two reasons:

- We saw in the first part that the variable used to build this indicator could be the margin or the turnover. This leads to different calculation formulas.

- The calculation formula also depends on the business model of the activity. This needs some explaining…

The formula for calculating LTV, in a way, will always be:

[What a customer earns me per month] X [Customer Lifetime].

But the calculation of the first variable of the formula ([What the customer earns me per month]) is directly linked to the business model of the activity. In an e-commerce activity, what a customer brings me is calculated by the formula Average shopping cart X Purchase Frequency. In a subscription business model, the calculation is more straightforward: it is the price of the subscription.

What is the formula for calculating LTV in E-commerce?

In e-commerce, the Lifetime Value formula is as follows:

LFT = (Average Shopping Cart + Frequency + Gross Margin) / Churn Rate

Each element of this formula is itself an indicator with a calculation formula.

Average Shopping Cart

This is the turnover divided by the number of orders. A company that generates a turnover of €1,000,000 and has 30,000 orders has an average shopping cart of: 1,000,000 / 30,000 = €33.

Purchase frequency

Purchase frequency is calculated by dividing the total number of orders by the number of (unique) customers. If you have 1,000 orders per year and 50 customers, the purchase frequency is 1,000 / 50 = 20.

Gross margin

Gross margin is turnover minus purchase costs, divided by the turnover then multiplied by 100 to obtain a percentage.

For example, if you buy a product for 50 euros and resell it for 100 euros:

Gross margin = (100 – 50) / 100 = 0.5. → 0.5 x 100 = 50%. You make 50% gross margin.

Churn rate

The churn rate, or attrition rate, calculates the loss of customers over a period of time. It is calculated as follows:

Churn rate = (Number of customers at the end of the period – Number of customers at the start of the period) / Number of customers at the start of the period.

Again, multiply the result by 100 to get a percentage.

Let’s take an example. You want to calculate the attrition rate between January 1 and February 1. You had 110 customers on January 1, and you have 80 on February 1. Your attrition rate is equal to: (80 – 110) / 110 = – 0.27.

How to improve the Lifetime Value in E-commerce? (4 practical tips)

Improving lifetime value should be one of the main objectives of any e-commerce business. How to achieve it? To answer this question, we must assess each of the terms of the equation. Improving lifetime value involves improving one or more of the variables of the calculation formula that we developed earlier. This means:

- Improve the average shopping cart and/or

- Increase the purchase frequency and/or

- Increase the gross margin and/or

- Decrease the churn.

Here are 4 tips to improve each of these variables without claiming to be exhaustive. These are a few avenues to explore…

1. Improving the average shopping cart

Improving the average shopping cart means customers should place higher orders. How? By encouraging them to add more products to their cart. How? By offering them, during the buying journey, complementary products. This is called cross-selling. Another option is to offer customers higher-end products. We then speak of up-selling, widely used in the world of services and retail.

Here are some ideas to consider:

- Offer personalized products on the site, make product recommendations based on customer preferences. This implies, of course, that the visitor browsing the site is a known visitor.

- Send personalized email campaigns offering product recommendations based on purchase history and/or other information about your customers (purchase preferences, socio-demographic information, etc.).

- Highlight complementary or similar products during the buying journey, depending on the products added to the cart.

- Create product packs.

- Offer delivery beyond a certain purchase amount.

- Create a loyalty program to incentivize customers to buy more to earn points/rewards.

2. Improve the purchase frequency

You may have customers who buy a lot, have a large average shopping cart, and buy infrequently…or less often than you would like. There are different techniques to encourage customers to buy more often and thus increase their purchase frequency. But they essentially boil down to one thing: creating email or mobile campaigns and scenarios (and even postal direct marketing, if you use this channel). We think of promotional campaigns or abandoned cart relaunch scenarios (the abandoned cart relaunch is a great way to increase lifetime value!).

We are entering here into the mysteries of relationship marketing, into the relationship plan… By communicating regularly and relevantly with your customers and maintaining a customer relationship with them outside of purchasing times, you will be able to make them more loyal customers who purchase more. The subject is vast. We invite you to discover the complete guide to the relationship marketing plan published by our friends at Cartelis.

3. Improve gross margin

To increase gross margin, you have two levers:

- Increase prices.

- Reduce product purchasing costs.

Here are two ways to increase the gross margin:

- Use an inventory manager to estimate your restocking needs correctly and limit inventory to what is necessary while avoiding the out-of-stock risk (fatal in the e-commerce sector, where customers want to have everything right away).

- Market high-margin products. It’s simple and logical! The margin rate varies enormously from one product to another. You must identify and market products with a high margin rate while remaining in your universe. You can also highlight in your communications the products with the highest margin rate (see the product recommendations we were talking about above).

4. Reduce the churn rate

The churn rate is a very complex metric. There are many reasons and factors that can lead a customer to stop buying from you. There are no secrets to reducing churn: you need to increase customer retention, customer loyalty. This involves:

- The implementation of a concrete relational plan,

- A constantly renewed understanding of the needs of your target, to constantly adjust your offers in line with customer expectations,

- The improvement of the customer experience at all stages of the customer journey: improvement of the website, optimization of customer service, improvement of the services offered to the customer…

How to calculate the Lifetime Value using a Customer Data Platform?

Calculating and monitoring the Lifetime Value requires having aggregated, consolidated, unified data. The calculation formula presented above clearly highlights this need: you should have a clear knowledge of the average shopping cart, purchase frequency, gross margin, customer status, customer preferences, etc. But this knowledge is not enough; it still has to be unified, brought together in the same system. For this reason, our last advice is to invest in a solution for the unification of customer, transactional and financial data…

It is impossible to reasonably implement a strategy based on Lifetime Value without having a Unique Customer data Repository. Customer Data Platforms represent the modern solution for consolidating and unifying customer data (in the broad sense of the term, including transactional data, etc.).

With this type of solution, you can efficiently (and easily) calculate the lifetime value and use it to segment and personalize your relational marketing. Why “easily?” Because with a CDP, you have all the variables of the lifetime value formula in one place. Lifetime values can be calculated automatically in the CDP once you have collected all the necessary data.

In short: with a CDP, you can connect all your data, calculate the Lifetime Value, and send the calculated segments/aggregates to your activation tools to better communicate with your customers…and increase their Lifetime Value.

Conclusion

In e-commerce, there are many opportunities to maximize revenue. Client assets are generally underutilized. The Lifetime Value is one of the best indicator to help you increase the income of an e-commerce activity while remaining resolutely customer-centric. We have seen what it is, how to calculate it, why to use it, and how to improve it. Now, it’s up to you!